-

Helping Small Businesses Grow

by providing the best accounting and taxation tools and advises.

-

Automate your Bookkeeping

devoting energy and resources towards providing financial intelligence.

-

Accounting is Simple

Using tech to pool all data and sketch a meaningful, cohesive picture of your business.

Key reasons for being your accountants

We are Tech Savvy accountant’s who help small businesses grow and thrive by providing insight and clarity beyond the numbers.

You can be anywhere

You do not need an accountant local to you, simply because our advanced accounting cloud technology enables the work to be delivered remotely.

Our Fixed fee plans

We provide you with fixed fee plans, to enable you budget the service you choose and not have any surprised bills. We are happy to quote you for any additional services on your requirements.

Keeping you updated

It is our mission to keep you updated with the relevant regulations, information and news via emails, uploading articles on our web blog and through our social media. To keep you informative and take advantage of any upcoming opportunities.

Our support, your success

We are here to ease the pressure by organising your business finances, helping you find new opportunities, take control and have clear insights to give you the chance to grow and succeed.

We are Qualified Accountants

We are Members of the Chartered Institute of Management Accountants CIMA, and Certified Tax advisers and we have a wide variety of practice and industry experience.

Slick communication with you

Our success lies behind understanding the importance of communication with you. It is not just about doing a great job but it is answering your query instantly and becoming your trusted advisor.

Our Smart Bookkeeping

We are using the leading accountancy cloud solutions Xero and Freeagent. They are highly secure, flexible, scalable, affordable and innovative making our clients work much easier than ever before.

We have a Proven Track Record

We are promising to deliver you peace of mind, less downtime, faster problem solutions, data protection, streamlined communications, and simplicity in accountancy and tax management.

Changing your accountant

Changing your accountant doesn’t need to be painful. If you already have an accountant and unhappy with their services or prices, then becoming one of our clients is a straight forward and painless task. All you need to do is appoint us.

Limited Companies

Simple packages for small businesses

PREMIUM

per month/VAT included

-

Client portal

-

Budget plan

-

Monthly Bookkeeping service*

- Document management App

- Same day response service

- 5 Employees Payroll Bureau

- App’s diagnose and integration

- Performance management reports

- Accountancy and Tax Advice

- OnDemand Cash flow forecast

-

FOUNDATION FILING

Perfect solution for micro businesses and self employed Accounting & filing needs.

SELF EMPLOYED

VAT included

-

Preparation of year end self-employed accounts.

-

Preparation and submission of self-assessment tax return.

- Accountancy and Tax Advice.

- Advice on how much tax is due to pay and when by.

MICRO COMPANIES

VAT included

- Preparation and filling full Year-end accounts.

- Preparation and filing Corporation Tax Return CT600.

- Preparation and filling Companies house accounts.

- Advice on how much tax is due to pay and when by.

Automation

Automating common bookkeeping and accounting tasks by replacing data entry with data capturing will free you up to focus on business insights, looking at trends, margins and ratios, and identifying areas for improvement.

Unfortunately, most of small business owners currently devote less than 10 percent of their time to these highly cognitive tasks and spend the other 90 percent of the time gathering and inputting accurate bookkeeping data.

We helped many business owners focusing on reading charts and creating value by automating common and repeated tasks.

Services

For all your accountancy needs

Accountancy

We prepper accounts for any size business whether you manage your accounts monthly, quarterly or annually.

Tax planning

Tax is a good thing – our money keeps the country running. But paying too much tax is not a good thing.

Budgeting

Budgeting is important both in business and in personal life. At KCPA Accountants, the team can help.

Start-Up support

If you are intending to start a business then the best advice we can give you is speak to an accountant.

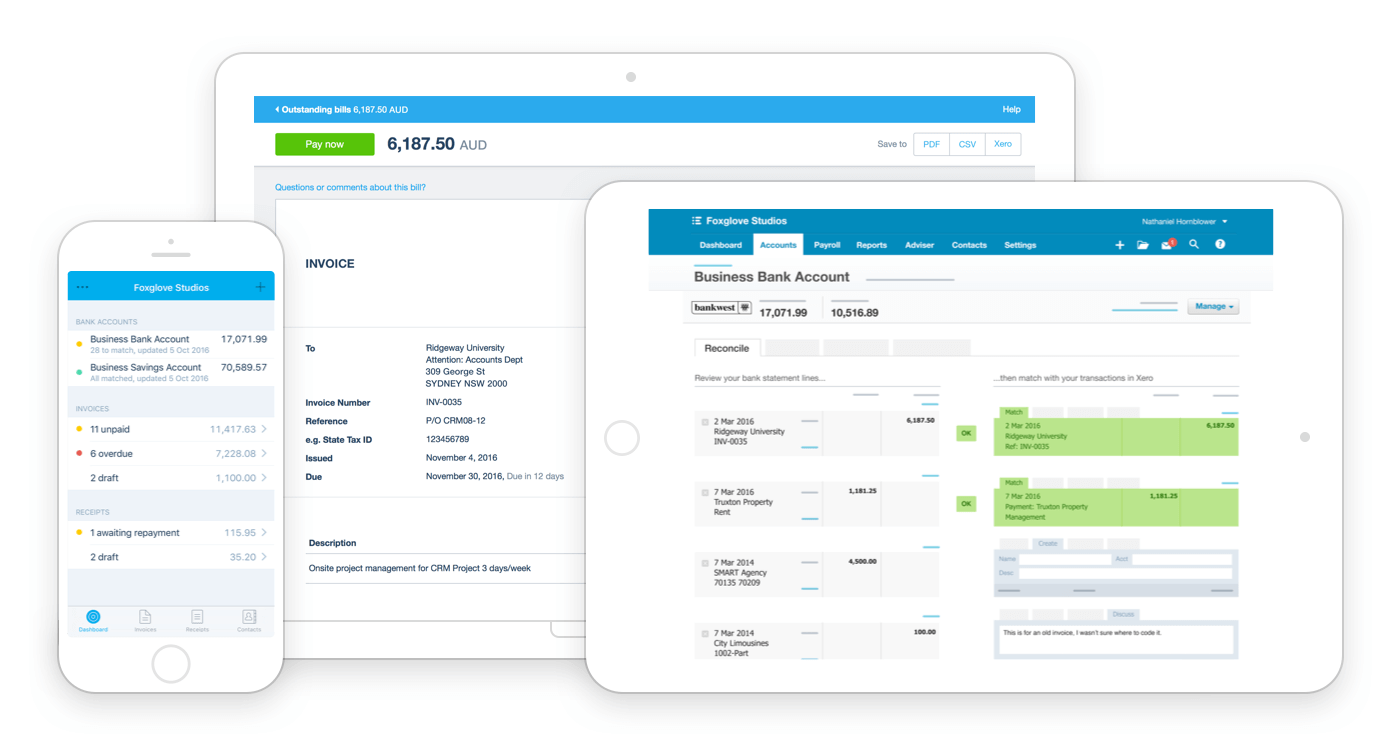

Xero

Xero is an excellent online accounting product, and we think it is the future for small business accounting. But to take advantage of its full advantages, you also need support and advice up to the same high standard from your accountant.

There are many cloud and online accounting systems on the market, and we are happy to support any if it is the best for your business. We have chosen Xero as our preferred partner because we feel it is the most complete all-around product.

Frequently Asked Questions

If you can’t find your answers here please contact us.

If you want to start working as self-employed, you must register with HM Revenue & Customs, but first make sure you have a National Insurance Number. After the registration, you will receive your Unique Taxpayer Reference (UTR) and HMRC will set up the right tax and National Insurance contributions records. You should keep your UTR safe because you will need it when completing your Self-assessment tax return.

If you are doing business in the UK but your turnover is below the threshold for registration, you may register for VAT voluntarily. Remember to regularly check if your turnover has exceeded the threshold and you need to register.

You may find it beneficial to be able to charge VAT on your sales and claim back VAT on your purchases in various ways. By way of example, if there is a zero VAT rate for the items you sell but you buy standard-rated items, HMRC will give you a VAT refund. Note that if you voluntarily register for VAT, you have the same rights but also responsibilities as in the case of compulsory registration.

The flat rate VAT scheme is aimed at simplifying VAT for smaller businesses with an anticipated turnover of up to £150,000 (gross) per annum. You pay VAT to HMRC as a flat rate percentage on your gross sales. The flat rate percentages vary depending on business activity. Under the flat rate scheme you cannot reclaim VAT on your purchases and expenses, but you can on larger capital purchases of equipment over £2,000. Once you enter the flat rate scheme you are free to leave at any time, but then cannot re-enter the scheme for 12 months.

If you need to close your business you should plan it carefully. First of all, it is important that you inform HMRC of your intent. Only then will you be able to settle matters related to tax and National Insurance. In some circumstances it is possible to extend the deadlines for payments or even to claim back some tax or National Insurance.

If you have decided to close your limited company, the company reserves will indicate the closure process where its liquidation or strike off.

We can help you in calculating the company reserves and any outstanding liabilities or refund to meet the legal requirements and get any relief available to you contact us so we can help you take the right action at the right time.

Definitely. The company can make payments into pension plans which are a tax-deductible expense for the company.

Yes, you can, but you should look at it as a short-term measure. It’s best to speak us prior to moving funds to ensure you are aware of all the implications.

The first thing you need to know is dividends are paid to shareholders from the company’s retained profit after tax, so you need to make sure the payment reflects the number and class of shares held.

An annual return is a document that is filed once a year at Companies House. It provides non-financial information about the company and ensures the public record is kept up to date. Companies House require a fee of £13 to file this document electronically and £45 to file a paper version (2013-2014). We charge a little admin fee should you require assistance for filling.

Yes. Most companies Memorandums and Articles allow a wide range of business activities. You can run more than one activity through a company. As long as it is legal! We can help you understand your companies Memorandums and Articles and adopt new ones where required to suit your business needs.

Be aware of this! Depending upon the nature of your business, it may affect you and potentially undermine the benefits of trading through a limited company. IR35 is HMRC tax legislation that was introduced to identify contractors who are receiving the tax benefits of working through a Limited company when they are really a disguised employee of the clients